A Guide to Opening a Business Bank Account

If you’re the owner of some limited company, you’ll need to come up with your business bank account in order to get paid. Limited companies are a separate entity from the shareholders and directors legally and, therefore, the money of the company should be traceable at any stage of financial transaction. Here is a quick guide for opening your business bank account for this purpose.

Where to start from?

The first thought that crosses many people’s minds for opening a business bank account is to open it with their bank. It might be a quick and convenient option because the bank you have your account with knows you already and your identity can be easily validated. However, there are other directors in the company who may use other banks for their banking needs. Besides, your first goal should be to find out one of the best deals out there. And even though your current bank may fulfill your personal banking needs adequately, it is not necessary for it to do the same with your business banking needs. So, choose wisely.

What will be needed?

In order to open your business bank account, you will have to come up with:

- Identity proof – your driving license or passport

- Personal address proof – a utility bill or current bank statement

- Registration details of the company house and the incorporation certificate

- Contact and address details of your business

- All details of credit and debit cards you hold currently

Which bank you should choose?

Some important considerations that you should make while selecting a bank to open your business account include:

Fees – There are many banks that offer the best introductory prices but as soon as the introductory period expires, the rates rise quickly. Better go for banks that offer business banking for free.

Referrals – Ask around to see what kind of service different banks offer to their business account holders and how satisfied their clients are.

Phone banking – Sometimes or the other you have to call the bank for different reasons. So, consider the quality of their phone banking services and find out how well they assist their customers and entertain their requests over phone calls.

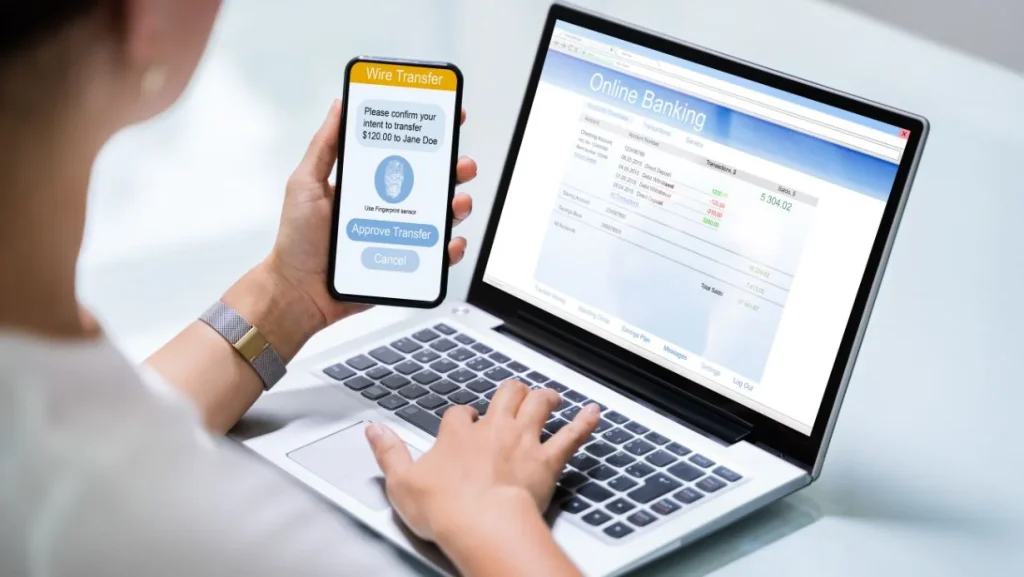

Online banking – Yet another important consideration! Making online payments is a lot easier and saves you from the hassle of issuing checks and visiting your bank every time you have to make a transaction. You also have real-time access to your account this way.